Considering Your 401(k) for Home Purchase?

Pondering the idea of homeownership and how to gather the funds for a down payment?

You're in good company. A common consideration for many is to utilize their 401(k) savings for this purpose. However, before you tap into your retirement nest egg for a house, it's crucial to weigh all other possibilities and seek advice from a financial advisor.

Here's the rationale.

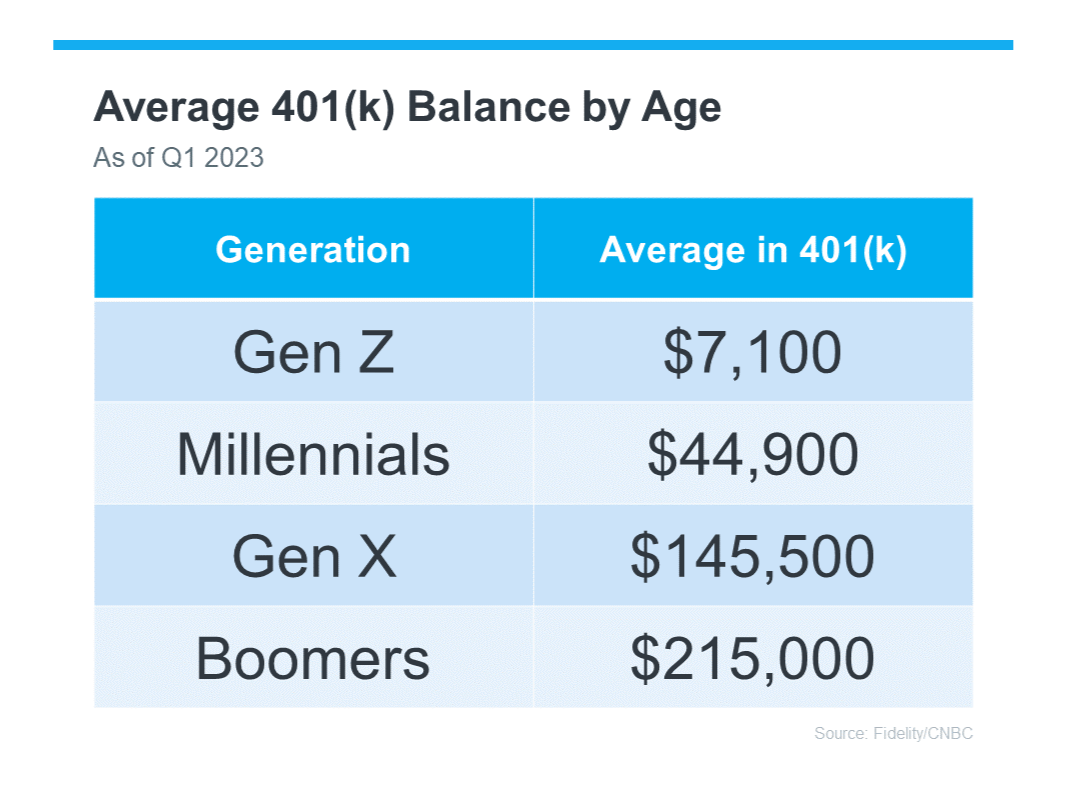

The Appeal of Your 401(k) Balance Statistics reveal that numerous Americans have amassed significant retirement savings (refer to the chart below):

The temptation is real when your 401(k) boasts a substantial balance, and your ideal home seems within reach. But it's vital to remember that using retirement funds for a home purchase might incur penalties and impact your future financial health. Hence, it's essential to thoroughly investigate all avenues for accumulating a down payment and purchasing a home. As Experian notes:

"Although it's feasible to apply your 401(k) funds for a house purchase, the decision should hinge on various factors, including potential taxes and penalties, your existing savings, and your specific financial situation."

Other Home Buying Strategies While tapping into your 401(k) is an option, it's not the sole path to homeownership. Before making a decision, explore these alternatives suggested by Experian:

FHA Loan: FHA loans enable eligible buyers to make a down payment as low as 3.5% of the property's value, depending on their credit scores.

Down Payment Assistance Programs: Numerous national and local initiatives exist to aid both first-time and repeat buyers in securing the needed down payment.

The Importance of a Strategic Approach Regardless of your chosen method for home acquisition, consulting a financial expert beforehand is imperative. Collaborating with professionals to devise a solid plan before embarking on your home-buying journey is crucial for success. Kelly Palmer, Founder of The Wealthy Parent, advises:

"I've observed parents halting their retirement contributions to afford a bigger house, often hoping for a future refinance... Provided there's a concrete strategy to resume saving for retirement, I advocate for families to assess all available options."

In Summary:

If you're still contemplating using your 401(k) for a home down payment, it's important to explore every avenue and collaborate with a financial expert before finalizing your decision.

Recent Posts

“Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! ”